1. Context & Stakes

The business problem

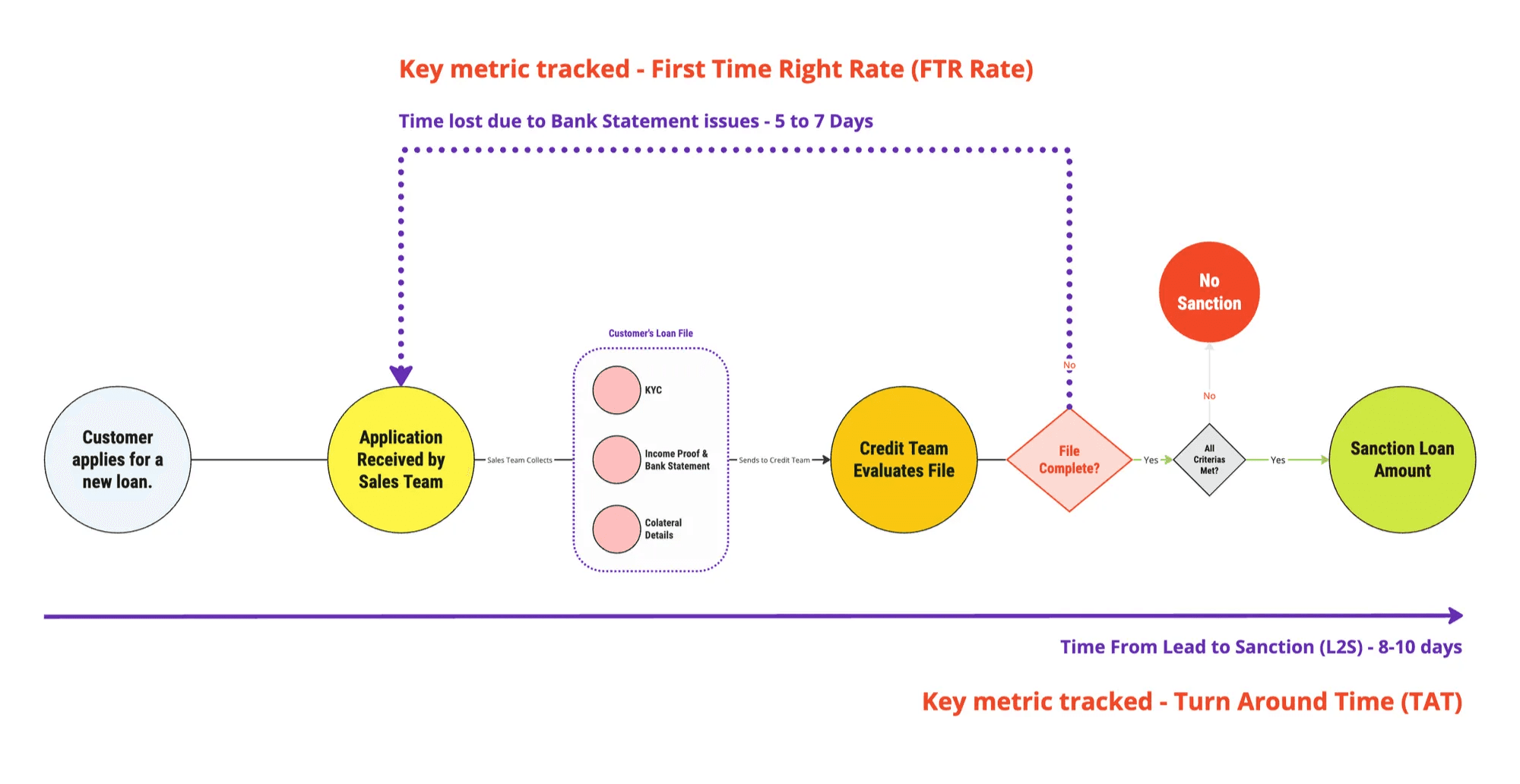

Piramal Finance was launching single-day loan disbursals, but one step consistently broke the promise.

60% of loan applications stalled during bank statement collection, inflating turnaround time by 5–7 days and directly impacting disbursal velocity.

This made two metrics critical:

First-Time-Right (FTR) — correctness of submissions

Turnaround Time (TAT) — lead to sanction duration

2.My role

As the Product Design Lead, I owned:

Problem framing & research

End-to-end UX strategy

Platform discovery with external vendors

Design decisions across mobile, system logic, and adoption mechanics

Collaboration

I partnered closely with:

Product & business leadership

Sales & underwriting teams

30+ engineers and QA

External Account Aggregator providers (OneMoney, Finvu, Anumati)

3. Understanding the Underlying Reasons Behind the Problem

What we discovered in the field

Through contextual inquiry and shadowing across 4 branches and 10+ sales executives, we discovered what initially appeared to be a simple document upload problem turned out to be a multi-layered system failure, spanning people, process, and technology.

1. Human & behavioural breakdown

Sales executives operated in high-pressure environments, often on the move. Bank statement collection was treated as a clerical step, not a risk-heavy verification task. As a result:

Photos were taken in poor lighting or at awkward angles

Statements were often incomplete or outdated

Errors were only discovered much later by underwriting teams

This created a delayed feedback loop where mistakes surfaced days after submission, increasing rework and frustration on both ends.

2. Process inefficiencies

The process assumed that:

Customers had updated passbooks

Statements were readily available digitally

Sales teams could verify correctness upfront

In reality:

Statements could span 200–500 pages due to UPI usage

Physical-to-digital conversion was manual and error-prone

Each rejection triggered back-and-forth between sales, customers, and underwriting

This made the system fragile—small mistakes cascaded into 5–7 day delays.

3. Technology limitations

From a system perspective:

Uploaded files lacked structure

Verification depended heavily on manual review

There was no way to enforce correctness at the point of entry

The system optimised for submission, not accuracy, which directly hurt First-Time-Right (FTR) and Turnaround Time (TAT).

Key insight: The system wasn’t broken because users made mistakes — it was broken because it allowed mistakes to pass silently.

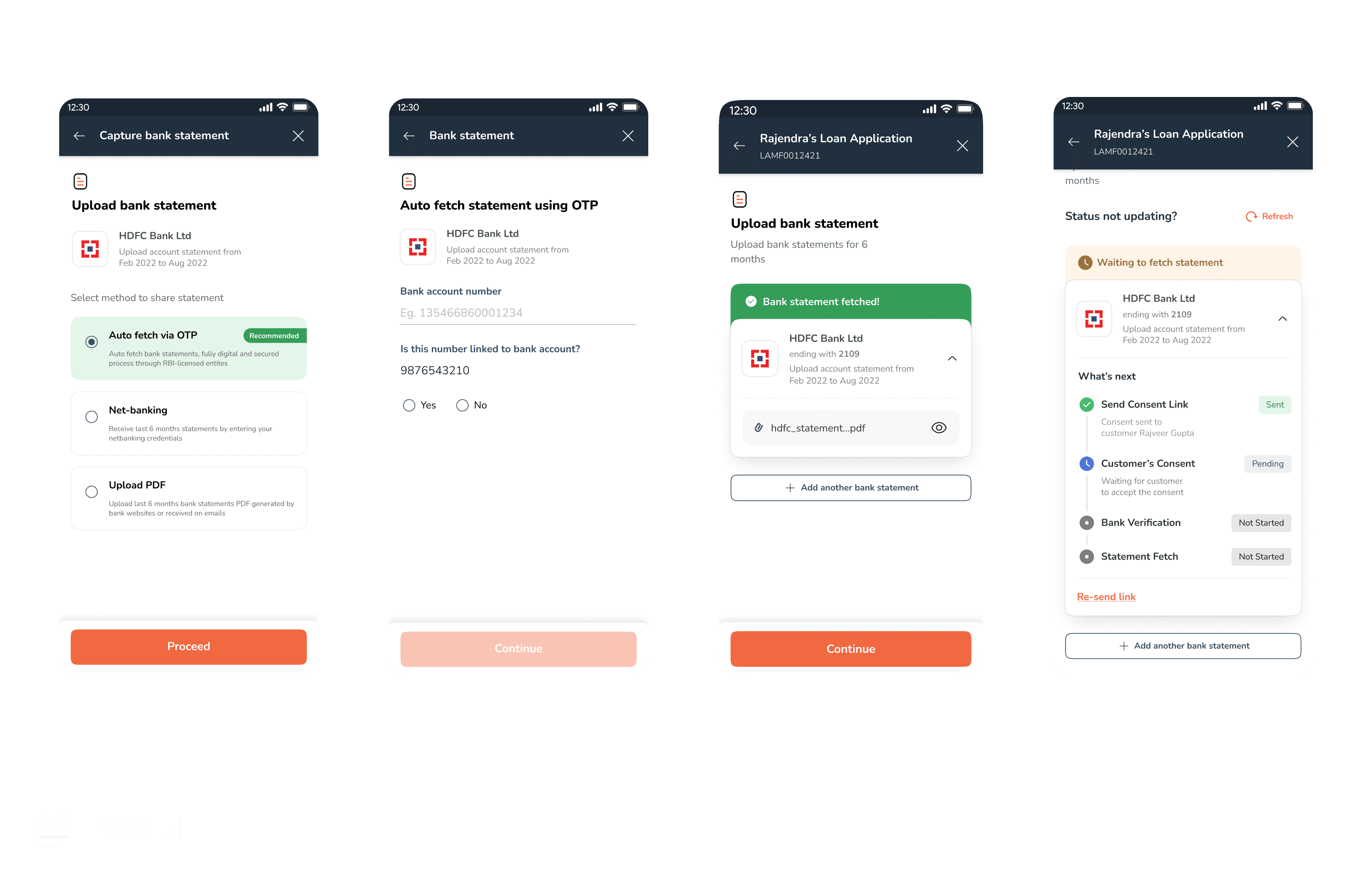

Existing System Collection Flow

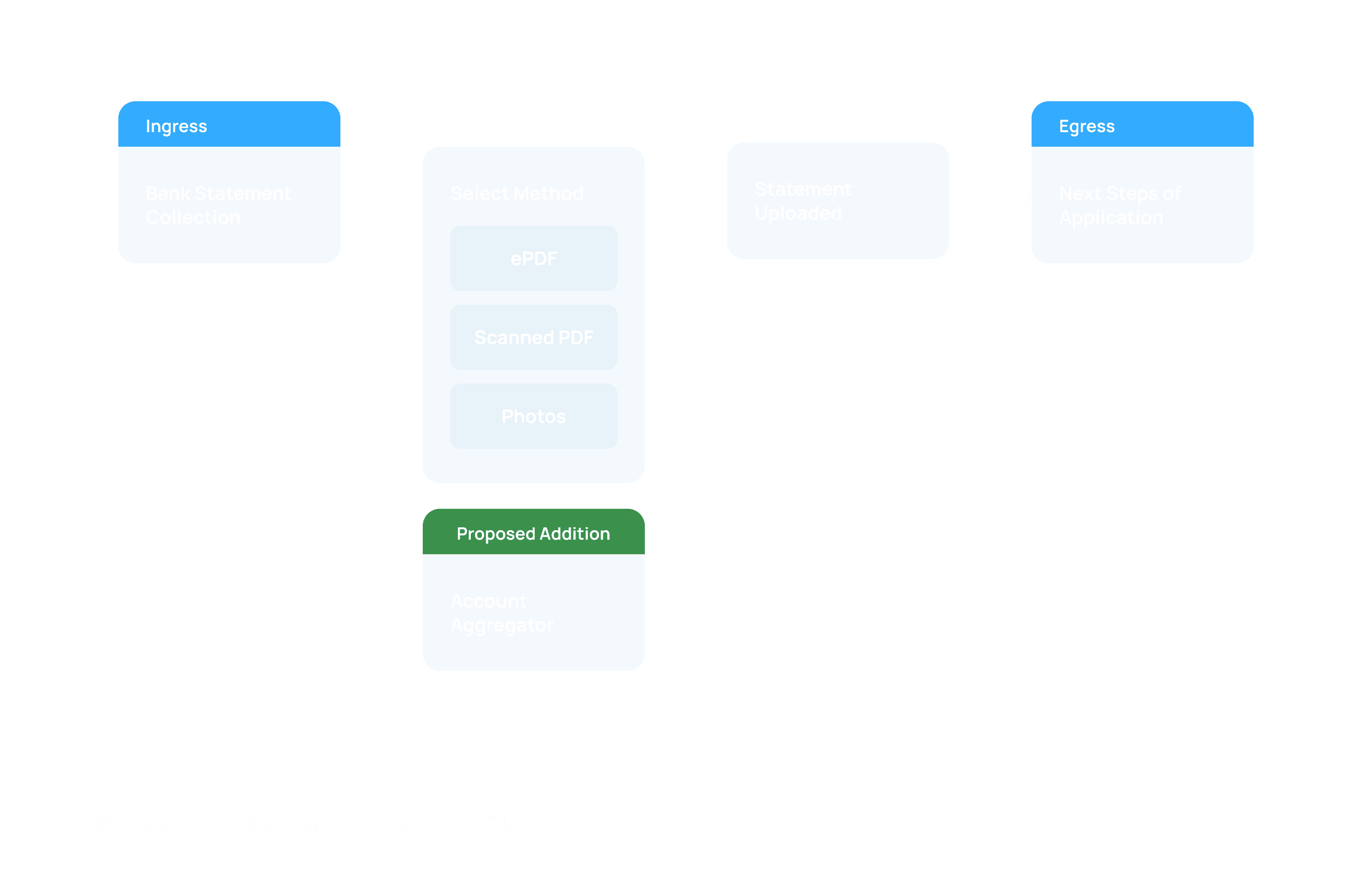

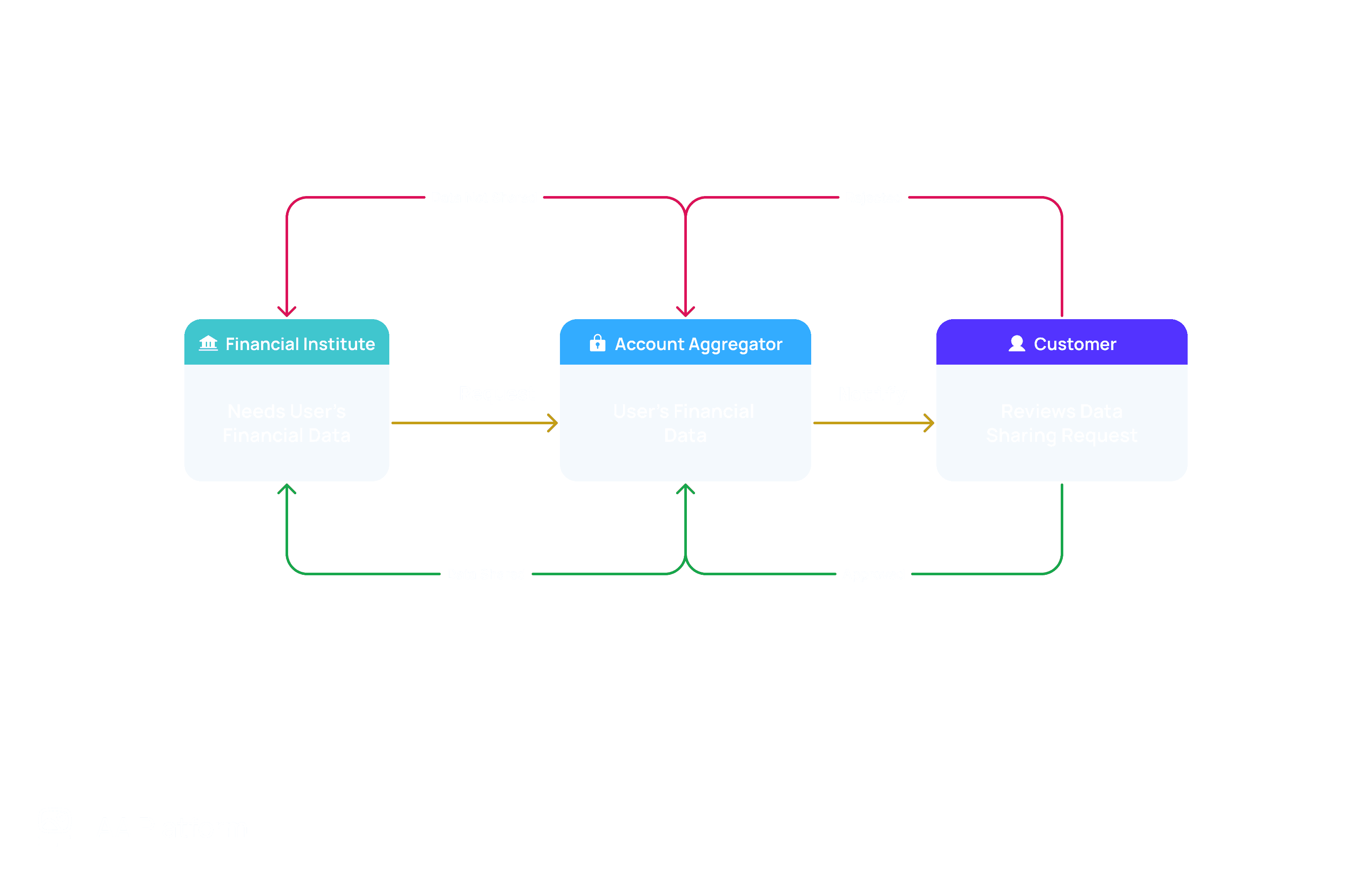

4. Strategy shift: Automating trust

Why Account Aggregator (AA)

We aligned on using the RBI-backed Account Aggregator platform, which allows secure, consent-driven access to bank data — similar to how UPI transformed payments.

This would:

Eliminate manual uploads

Provide structured, credible transaction data

Remove ambiguity for underwriting

Constraint: No financial institution had implemented an assisted AA journey before.

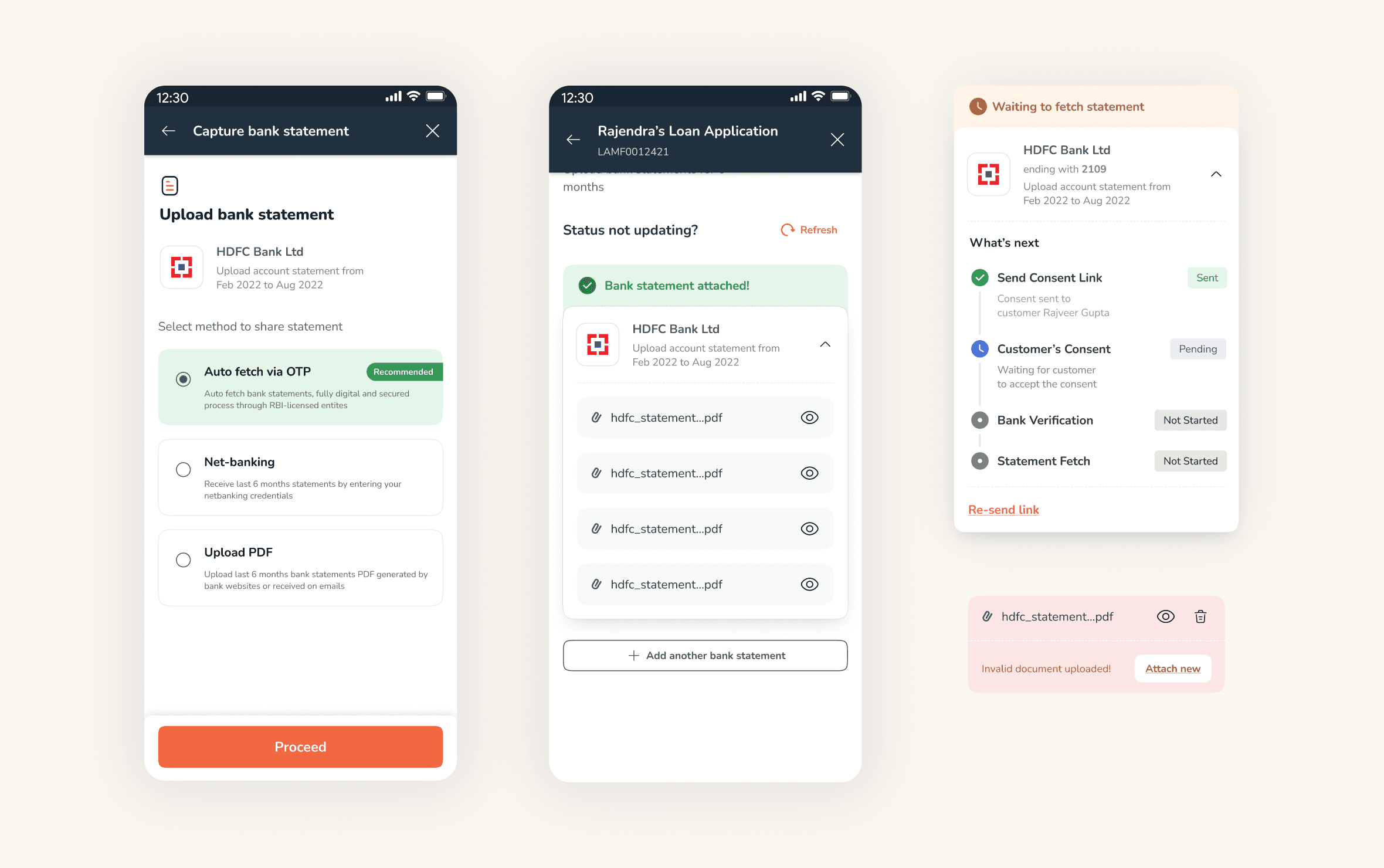

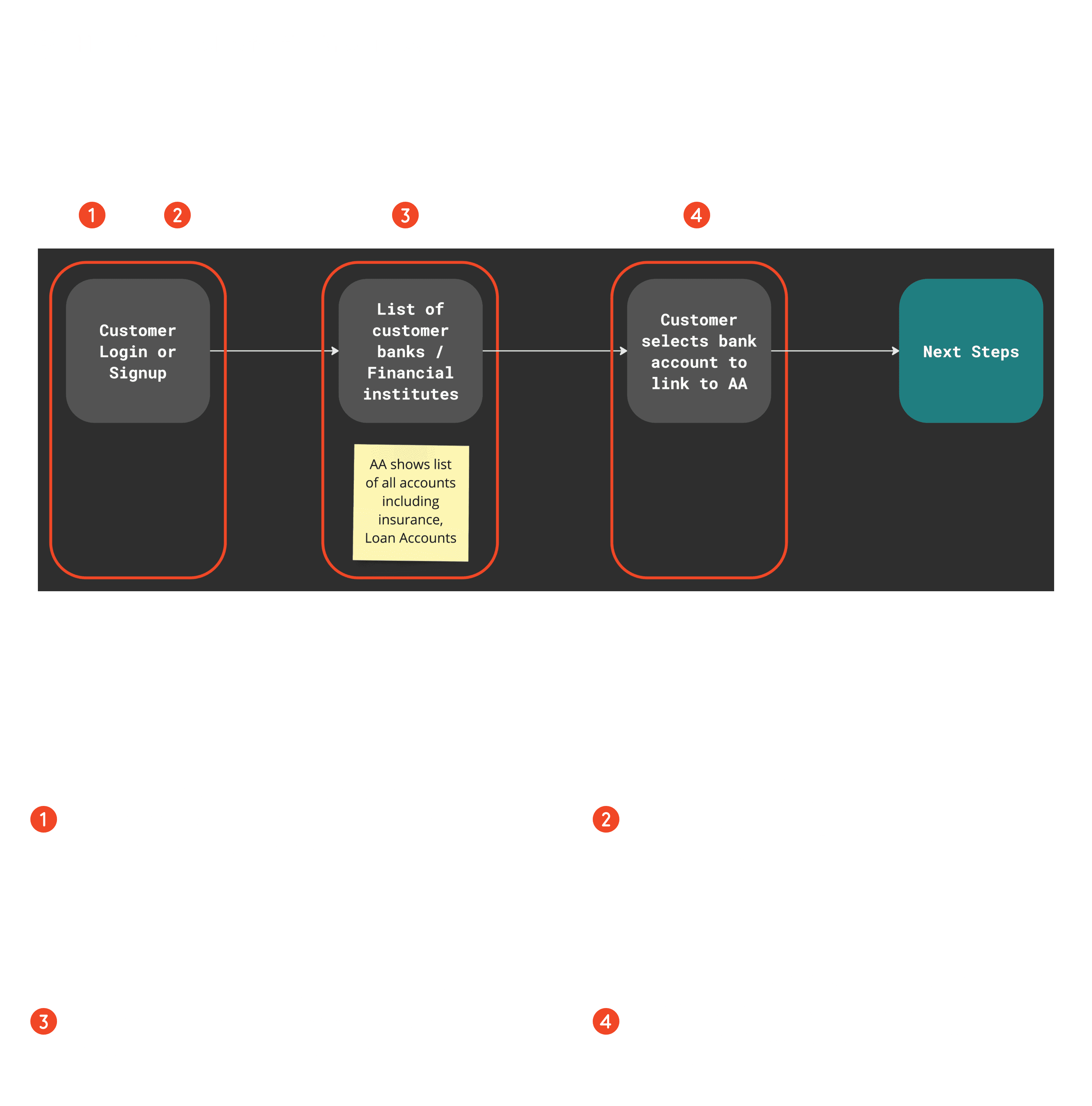

5. Designing under platform & time constraints

Platform discovery

I worked directly with AA providers to understand:

Platform flows

Consent mechanics

Technical constraints

UI customization limits

Key tradeoff

Although UI customization was possible, we chose to:

Use TPA-provided, battle-tested UI

Prioritize speed, reliability, and time-to-market

This decision reduced risk and allowed faster validation.

6. V1 failure → learning → redesign

Key Design Decisions to Reduce Errors

The design strategy focused on shifting error detection upstream, from underwriting to the moment of data capture.

Decision 1: Automate trust, don’t digitise paperwork

Rather than improving the upload experience, we questioned the premise entirely:

Why were we asking users to submit documents that already existed digitally?

Why was correctness verified after submission instead of during capture?

This reframed the problem from better uploads to eliminating uploads altogether using Account Aggregators.

Decision 2: Design for platform constraints, not ideal flows

The AA journey was largely outside our control and dictated by third-party providers. Instead of fighting this:

We treated the AA flow as a black box

Designed our system to gracefully hand off and recover from it

This reduced integration risk and allowed faster iteration.

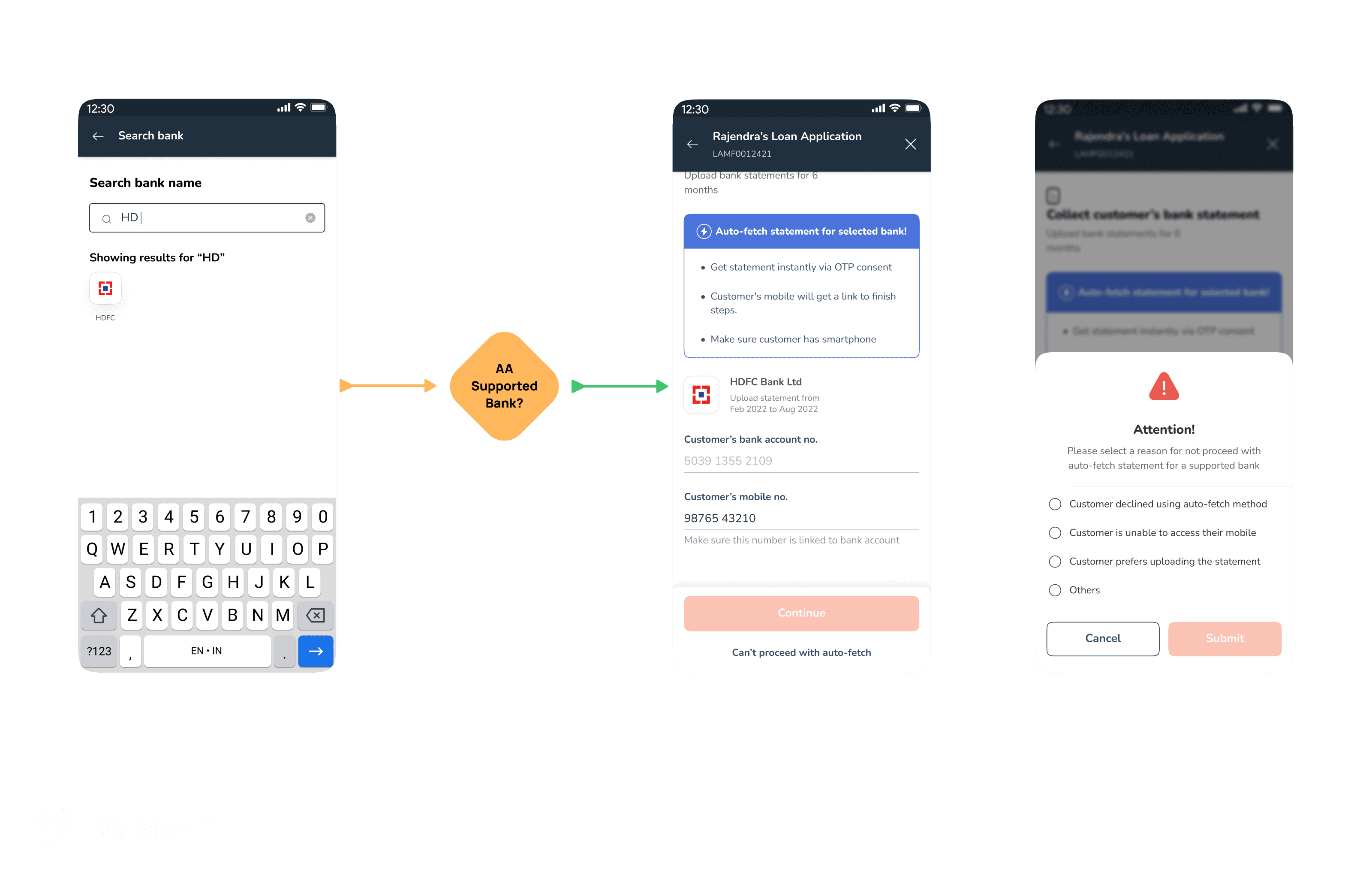

Decision 3: Handle edge cases as first-class citizens

We explicitly designed for:

Customers without smartphones

Unsupported banks

Poor image quality

AA downtime

Fallback flows weren’t hidden—they were validated, structured, and instrumented, ensuring underwriting received usable data even in failure scenarios.

Decision 4: Reduce cognitive burden for sales

Sales executives were not incentivised to evaluate document correctness.

So instead of expecting better judgment, we:

Encoded validation into the system

Reduced reliance on human discretion

Let the system do the policing

This aligned incentives without retraining behaviour.

What failed

Despite strong internal excitement:

V1 adoption stalled at ~2%

Sales teams hesitated due to unfamiliarity

Trust barriers outweighed efficiency gains

The insight

The problem wasn’t usability — it was behavioral resistance to a new system. So we stopped asking users to choose the better path.

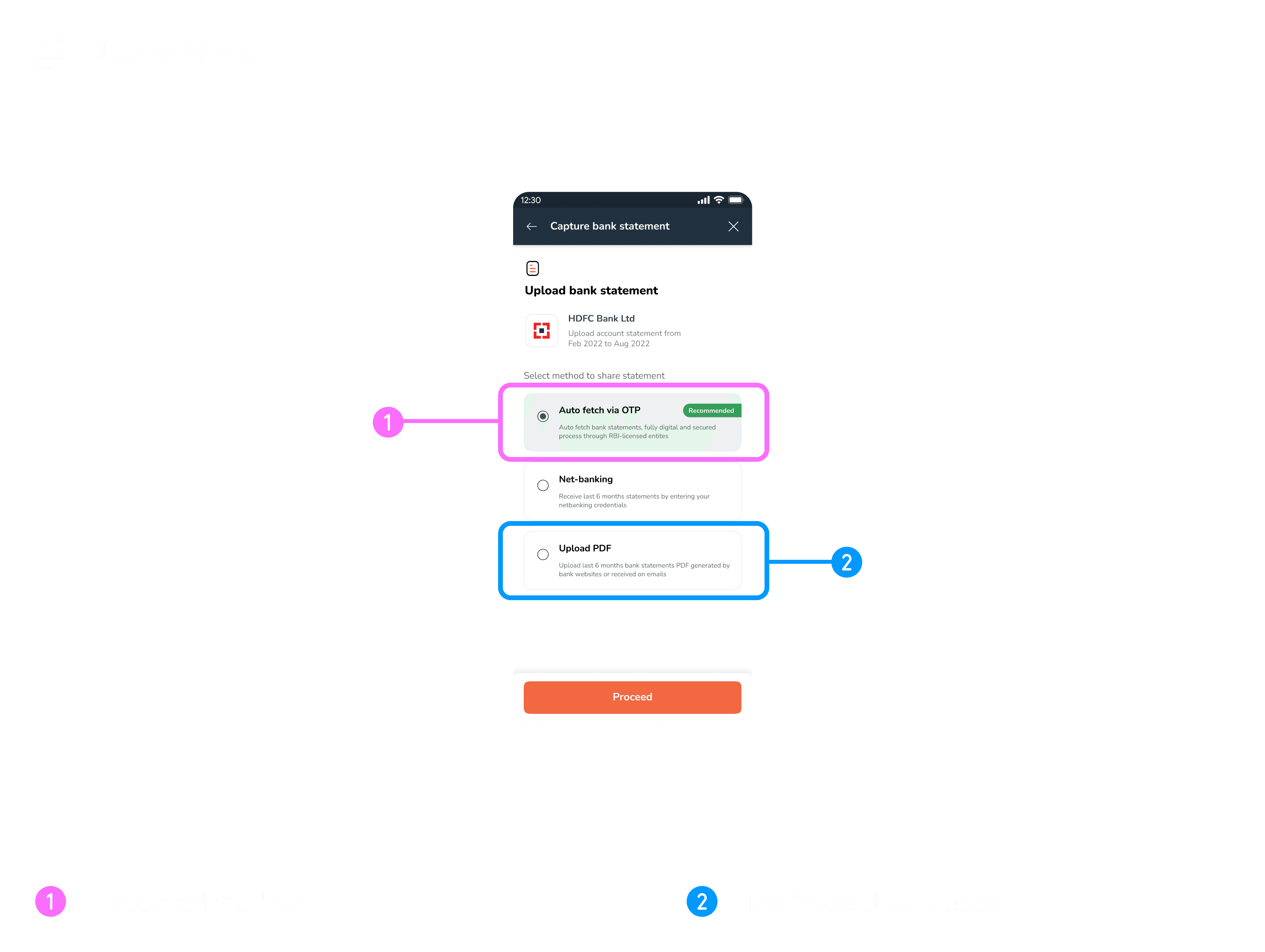

7. V1.1: System-driven behavior design

The failure of V1 revealed a critical insight:

Efficiency alone does not drive adoption — trust and familiarity do.

What changed in V2

1. System-guided default paths

For supported banks:

The AA method was auto-recommended

Manual alternatives were de-emphasised

This reframed AA as the normal path, not an optional one.

2. Instrumented deviation, not forced compliance

When users deviated from the AA path, the system required them to:

Select a reason for opting out

This served as:

A learning mechanism (understanding resistance)

A governance tool (distinguishing genuine constraints from avoidance)

3. Behaviour reinforced beyond UI

Adoption was reinforced through:

Sales education

Manager-level nudges

System-level defaults

The result was a sustained shift in behaviour, not a one-time UI improvement.

8. Impact

Results

Adoption: 2% → ~70%

Even with limited AA bank coverage

FTR: 100% for AA-based cases

Zero back-and-forth

TAT: 5–7 days → ~2 minutes

Underwriting efficiency:

Structured XML data

No manual verification

Faster, more confident decisions

This unlocked true single-day disbursals.

9.Key takeaways

Designing systems beats designing screens

Adoption requires behavior design, not just UX

Failure is data — if you listen closely

Product impact often lives beyond the interface