From 7 Days to 2 Minutes - Revolutionising Bank Statement Collection

Revolutionizing bank statement collection by reducing time from 5-7 days to 2 minutes, achieving 70% adoption

Project Overview

At Piramal Finance, the mission was to revolutionise the sales process by replacing the outdated Salesforce SFDC tool with an innovative sales app. This app aimed to enable sales executives to generate leads and process loan applications seamlessly on mobile devices.

My Role

Being the Product Leader - I was responsible for UX Research, UX Design & UI Design

Team

I collaborated closely with the Product Manager, Business, and Sales teams, alongside 30+ developers and QA specialists, Product Support, contract agencies, and third-party providers.

The Problem

The bank statement collection process was a significant bottleneck, causing 60% of loan applications to stall. This step increased the turnaround time (TAT) by 5-7 days to a critical delay, significantly affecting the business's efficiency.

This issue was also hampering our newly launched "single day disbursals"

The important goal for us was to improve 2 major KPIs:

Reduce the Turn-Around-Time (TAT) for the statement collection step

Increase the First-Time-Right rate (FTR)

Understanding The Underlying Reasons Behind The Problem

We visited 4 different branch offices and interacted over 10 sales persons. The best suited research method for us was contextual enquiries and shadowing our sales persons. We also spoke with a couple of our customers.

The insights from the interviews were eye opening -

The statement collection process which we thought to be very simple, had in-fact problems at 3 different levels -

How Do We Speed-up The Collection & Verification Process?

All the stakeholders had come to a unanimous decision to automate this process through Account Aggregator platform.

The integration of the new method was not a cake-walk though! It required a detailed technical and implementation discovery - which i conducted by connecting with our three major TPA providers - OneMoney, Finvu and Anumati.

What is Account Aggregator?

An Account Aggregator is a platform that securely stores the financial data of Indian citizens and enables its sharing with financial institutions, with the user’s consent digitally verified through an OTP.

When I began my discovery, I found that although the platform supported the assisted journey, no financial institution had integrated it into their ecosystem.

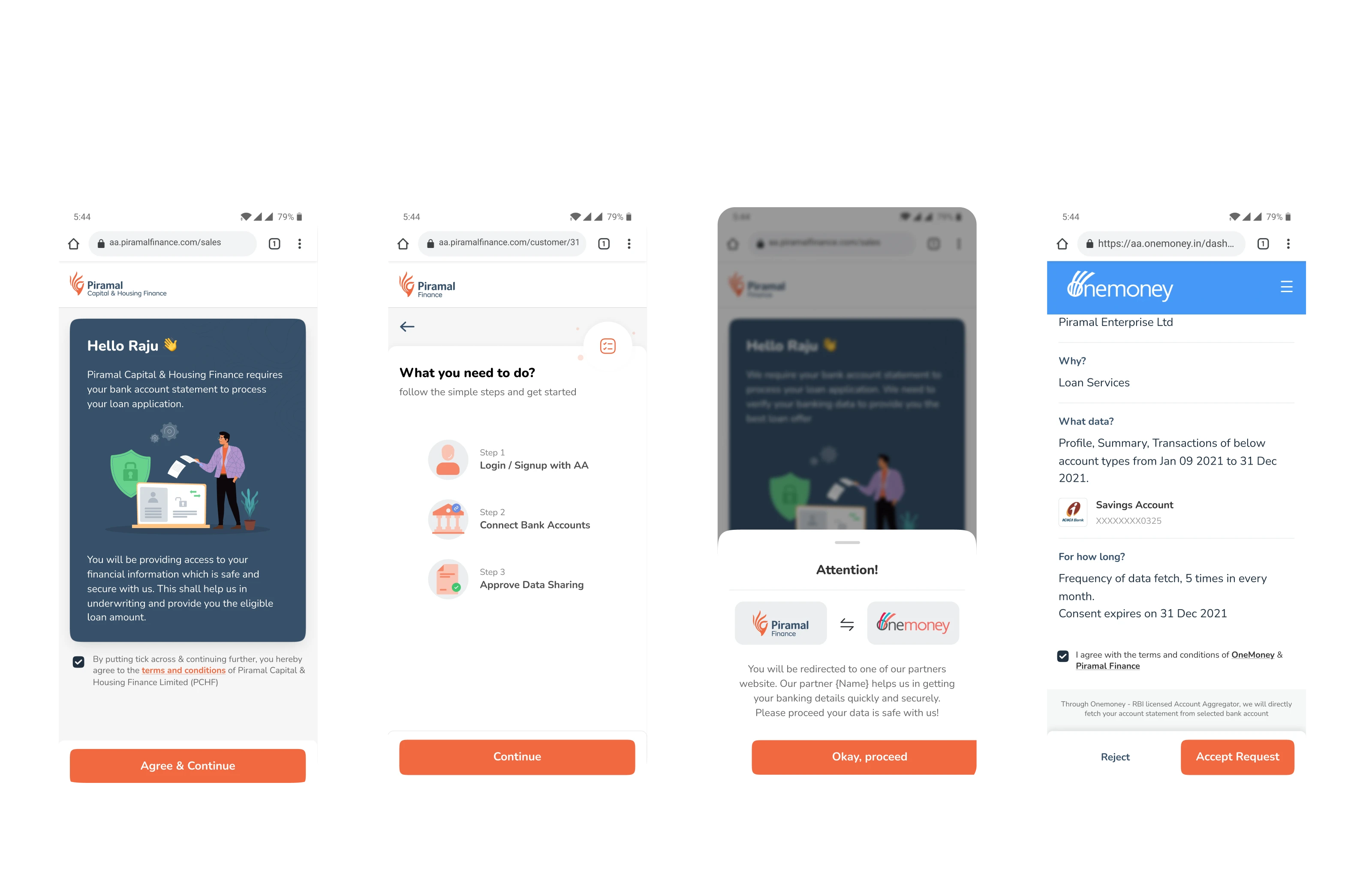

Updated Bank Statement Collection Flow

The discovery process helped in understanding the platform flow, features, technical constraints and set the direction for my design direction.

The AA platform journey was beyond our control, and the flow proceeded as outlined below.

This flow directly impacted how we tweak the flow on Sales central side to avoid - errors and speed-up the statement collection.

Key Design Decisions to reduce errors

These were the key areas where we anticipated potential friction points that could delay task completion.

To address this, I worked closely with the PM and Dev team to identify all possible edge cases and devise the best technical solutions.

For instance, we brainstormed a fallback solution for customers without a smartphone, relying solely on a physical bank statement. Our approach included detecting poor image quality, validating the statement’s accuracy, running OCR, and generating an XML document from the statement data reducing the verification time.

The New Flow

We were phasing out the outdated, inefficient design and aligning the new UI with Piramal’s Mudra Design System foundations to ensure consistency, scalability, and a more seamless user experience.

I designed two approaches for the statement collection process -

I presented both versions to the design team, and V2 received strong support for its uniform layout, seamless progressive disclosure, and clearer guidance through the user journey.

Impact of New Design

This revolutanary design failed miserably with only 2% adoption rate after 2 months of launch

We conducted a field visit to one of our branch offices to engage with the sales team and uncover pain points firsthand. Through contextual inquiry, we discovered that users were hesitant to adopt the Account Aggregator method due to a lack of familiarity.

This insight prompted us to iterate further, focusing on building a system driven flow

We made some minor tweakes to the flow -

The system would automatically push for the AA method for the supported banks

We introduced additional friction points to make it difficult for users to deviate from the system dictated flow

Withing 2 months of launch we saw

Read next case-study